The ICV Think Tank

As a think tank within the Association, the Think Tank has provided impetus for new ideas, adaptations and applications in management accounting since 2001. With the publication of Dream Car Reports and Think Tank Updates (previously: Think Tank Quarterlies), it regularly shares the latest developments and findings with all those interested in management accounting. Within the Association, the Think Tank initiates the establishment of topic-specific expert work groups that develop practicable models, methods and instruments and make them available to the controlling community in publications. The Think Tank is thus both a pioneer and a driver in controlling theory and practice.

Since its foundation in 2001, the Think Tank has continued to develop and is now a dynamic and diverse group that can look at the core topics of controlling and corporate management from many different angles.

Are you interested in getting to know the Think Tank and its members and contributing your expertise? We look forward to hearing from you.

How we work in the Think Tank

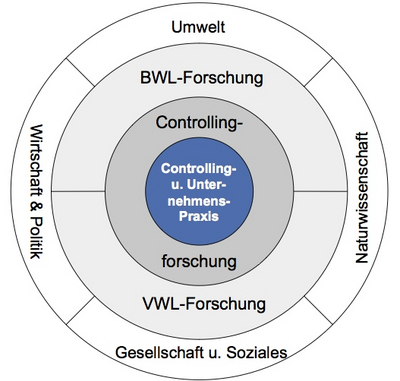

With the help of the “Controlling Radar”, we systematically monitor the controlling-relevant environment in order to identify key trends at an early stage. Every year, we focus on one trend topic. We use the latest findings to develop the annual Dream Car Report, a handbook for controllers. In this way, we make a significant contribution to positioning the ICV as a topic leader in the financial and controlling community.

Main topics

Until the Congress of Controllers on April 28/29, 2025 in Munich, the work group will address the topic of Controlling in the globalized world 2.0 – forecasting competence, adaptability & resilience.

In an increasingly globalized and dynamic world, it is essential for companies to strengthen their forecasting skills and increase their adaptability. The ability to accurately assess geopolitical developments and develop scenarios plays a central role in risk management and in identifying opportunities. Controlling makes a decisive contribution here by creating competitive advantages through regular risk assessments. The ability to change and adapt is another key competence that companies need to be successful in a rapidly changing environment. Flexible processes and agility make it possible to react quickly to changes and make strategic adjustments. In addition, resilience – the resistance of a company – is becoming increasingly important. Companies must be able to develop strategies and business models that are robust in the face of unforeseen events, for example by investing in redundant capacities and alternative supply chains (cf. O’Keeffe et al., 2024).

Our annual theme for 2024/2025 is dedicated to these topics. The aim of this work is to equip controllers with the necessary tools and strategies, e.g. in terms of flexibility and resilience, to successfully meet the challenges of the globalized world 2.0. The exchange of ideas and best practices should produce innovative solutions that strengthen the competitiveness and stability of companies in the long term.

With the thematic focus “Controlling and New Work – forms of work, skills, talent acquisition”, we are addressing current trends in the changing world of work and drawing a picture of the future of controlling. We will shed light on how New Work principles are changing roles and processes in controlling. We provide impulses for the change in the competence profile and deal with the differentiation of controlling roles. In addition, we address the war for talent and show how training and further education offers must be adapted in order to realize the future image of controlling.

The topic of sustainability with its environmental, social and governance dimensions is becoming increasingly important for future-proof corporate management. Controlling is therefore required to take this increased relevance into account and support the transformation process towards a sustainable company.

Sustainability controlling therefore plays an important role in supporting the implementation and ensuring the rationality of sustainability management and fulfilling regulatory requirements.

The guide provides the following information:

- Previous development and current drivers of sustainability management and sustainability controlling

- Regulatory developments and potential in relation to sustainability

- The nine key design factors for sustainable corporate management

- Maturity model & practical examples from Bosch Automotive Electronics, DATEV, TRUMPF, Deutsche Post DHL and the consulting firm Deloitte

With its combination of basic knowledge, implementation recommendations and practical examples, this Dream Car report is a complete basis for controllers who want to act as drivers and shapers of their organization’s sustainability transformation.

This Think Tank;s Dream Car Report is available for ICV members in the ICV Online Shop, for non-members from Haufe.

The ICV guideline “Servititation” supports controllers and managers in the transformation of business models and the adaptation of controlling tools.

The guide provides answers to the following questions:

- What are the success factors in the transformation to a service provider?

- How can controlling plan and manage this transformation?

- How does controlling need to further develop its organization, instruments and systems?

- How does the transformation work in practice? Success stories from TRUMPF/Munich

RE, Heidolph Instruments, Wibu Service+, SEW Eurodrive and Drägerwerk

This combination of basic knowledge and individual experience reports facilitates the transfer to the requirements in your own company.

The guide shows how controlling can make a decisive contribution to keeping companies on course in situations that threaten their existence. In addition to the systematic approaches, the practical examples from TRUMPF, Kärcher and Siemens provide valuable impetus.

If companies find themselves in a crisis or even in a situation that threatens their existence, it is the task of controlling to use its instruments to stabilize them and get them back on track. The associated tasks, instruments and processes can be described using a phase model

- starting with crisis detection and prevention

- short-term survival and stabilization

- through to realignment and a potential new start.

The aim of this guide is to support controllers and managers in selecting suitable tools. It provides answers to the following questions

- What is a crisis and how does it work? Classification and four-phase model

- How can crises be avoided? Organize crisis prediction and prevention in good time

- How can crises be overcome? Toolbox for improving earnings and liquidity

- How does it really work? Practical examples from Kärcher, TRUMPF and Siemens

This combination of basic knowledge and individual experience reports facilitates the transfer to the requirements in your own company.

Controlling elements are indispensable for start-ups in every phase of corporate development. However, due to serious structural differences, the transfer of classic controlling approaches is only possible to a limited extent. This ICV guide combines basic knowledge and best practice examples and thus supports the selection and application of suitable tools.

- Special features of start-ups and start-up initiatives

- Development of controlling tasks in the life cycle

- Best practice examples from Signavio, FlixBus, TRUMPF and Bosch.

- Controlling instruments from the start-up to the establishment on the market

Start-ups differ significantly from established companies, particularly in terms of their structures, organizational forms, flexibility, resources and decision-making speed. The same applies to start-up initiatives as drivers of innovation in large companies. Due to these serious structural differences, a transfer of classic controlling approaches is only possible to a limited extent. However, controlling elements are indispensable in every phase of corporate development. For this reason, the Think Tank of the International Association of Controllers (ICV) has developed this guide in collaboration with the EBS University of Business and Law and renowned authors from academia and practice.

The aim of this guide is to support controllers and managers in selecting suitable tools. To this end, it provides answers to the following questions:

- What exactly are start-ups and start-up initiatives and what are the different categories and types?

- How does the controlling of start-ups, in particular tasks, tools, key figures and roles, change over the life cycle?

- How are start-up programs and internal and external start-up investments managed individually and holistically within larger corporate groups?

The success factors and obstacles are illustrated using small to large start-ups or even grown-ups as well as successful start-up initiatives (e.g. incubators, accelerators, CVCs and hubs).

This combination of basic knowledge and individual best-practice examples facilitates the transfer to the requirements of your own growth initiatives.

The Dream Car Report 2018/2019 can be purchased in the ICV Online Shop.

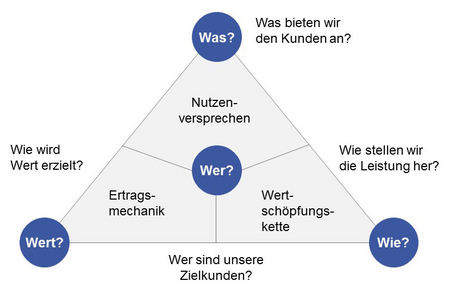

Digital business model innovations

The use of digital technologies (e.g. high-performance computers, broadband internet, etc.) can lead to significant changes in the central business model components “customers”, “value proposition”, “value chain” and “revenue mechanics” or to fundamentally new business models for companies (see Gassmann et al. 2013). When implementing digital business model innovations, several business model components are usually affected simultaneously. In the following, various application examples are used to illustrate the fundamental changes that can result from the use of digital technology in individual business model components.

- Business model component “Customers”

Customers are at the heart of business models. For example, it is considered which customer groups (e.g. B2C or B2B) the company focuses on. In this context, it is also defined how these customer groups should be addressed and how customer relationships should be structured. Amazon has popularized e-commerce through the use of digital technologies. In terms of the customer relationship, personal customer contact is dispensed with in comparison to “conventional” retail. Today, Amazon is the largest bookseller in the world without having opened a single retail store.

- “Value proposition” business model component

The “value proposition” business model component looks at the products and/or services the company offers its customers. The use of digital technologies makes it possible to replace physical products with dematerialized products. One example of this is MP3 technology and the associated offer of digital music. With iTunes, Apple has implemented a business model in which music is sold without data carriers (CDs, records, etc.). For a fee, customers download individual music tracks to their iPhone or iPod via iTunes. Apple has thus turned the music business upside down and has become the largest music retailer without having sold a single CD or record.

- “Value chain” business model component

The “value chain” business model component comprises all activities, processes and key resources that are required for the provision of services or implementation of the business model. In order to gain access to key resources that the company itself cannot provide, strategic partnerships are often formed with other companies or investments are made in start-ups. For example, Daimler AG founded car2go together with Europcar in order to enter the free-floating car sharing business. The entire car rental process is implemented using various digital technologies. For example, the customer’s smartphone is the central interface and serves as an information, booking and payment device.

- Business model component “earnings mechanics”

The earnings mechanics comprise the financial aspects of the business model. This includes both the cost structure and the sources of revenue. New concepts can be implemented through the use of digital technologies, particularly with regard to revenue sources. For example, Rolls Royce (manufacturer of turbines for civil and military aviation) has introduced the “pay-per-use” concept. Customers pay a fee for every hour the engine is running instead of buying the engine itself. In order to be able to offer such a concept, Rolls Royce records the operating data of the engines via sensors. This data is then collected and analyzed centrally.

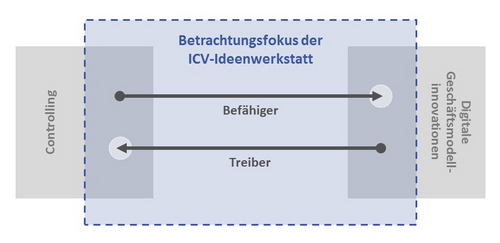

The role of the controller

The implementation of digital business model innovations, which change industries within a very short space of time, requires agility. This applies both to the business model itself and to controlling. In addition, the corporate culture is crucial for the development and implementation of digital business model innovations. From a controlling perspective, there are two key perspectives to consider: On the one hand, controlling acts as an enabler for the development of digital business model innovations; on the other hand, the implementation of such business model innovations should be seen as a driver for the adaptation of controlling instruments and methods (see Figure 2).

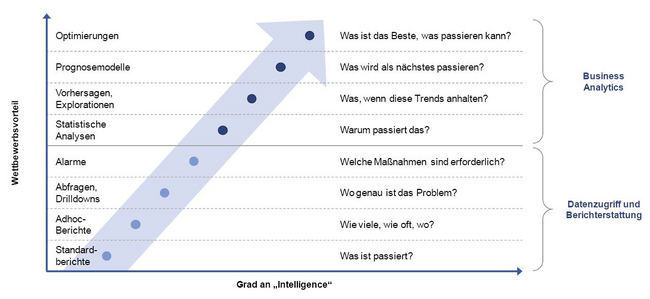

Focus on future-oriented analyses

What is meant by “business analytics”? Analytics refers to the comprehensive use of data, statistical and quantitative analyses as well as explanatory and predictive models (see Davenport/Harris, 2007). In this context, the term “business” emphasizes that these methods and models are used in an operational context to bring about data-driven management decisions. Data-driven predictions, forecasts and optimizations in particular can lead to improved management decisions and thus competitive advantages (see Figure 1).

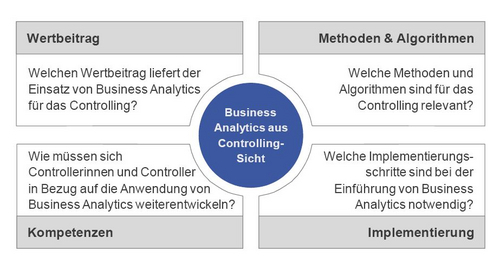

What questions arise from a controlling perspective?

Increasing digitalization is generating enormous amounts of data. Business analytics should make it possible to analyze these data volumes in a meaningful way and derive useful insights. With our work in the Think Tank, we want to find out how the use of business analytics affects controlling. We also want to show controllers suitable solutions for their practical work. In doing so, we will address four key questions (see Figure 2).

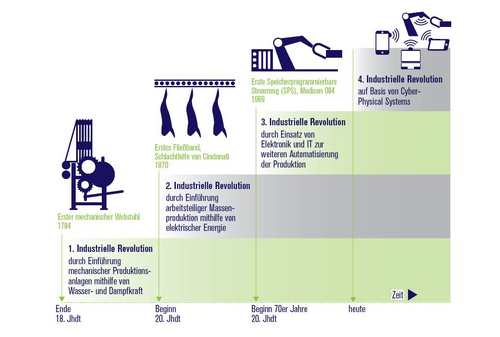

On the way to the fourth industrial revolution

Industry 4.0 is the megatrend in production and stands for intelligently networked factories and value chains. Experts predict an increase in productivity of up to 50% as a result. Figure 1 illustrates the path to the fourth industrial revolution.

The starting point of every industrial revolution was the use of new technologies and the associated improved organization and control of entire value chains:

- The first industrial revolution

The first industrial revolution began at the end of the 18th century with the introduction of mechanical production facilities. The development of the steam engine played a decisive role in this. With the help of the steam engine, the heat energy contained in steam could be converted into mechanical work. This made it possible to mechanize manual work using machines.

- The second industrial revolution

At the beginning of the 20th century, the introduction of mass production based on the division of labor with the help of electrical energy was a key driver of the second industrial revolution. In this context, it is often referred to as a revolution characterized by the organization of work. The assembly line introduced by Henry Ford within production and the principles of industrial work organization (Taylorism) developed by Frederick W. Taylor were formative in this context.

- The third industrial revolution

The beginning of the 1970s saw the start of the third industrial revolution, which continues to this day. The decisive factor here was the increasing use of electronics as well as information and communication technology, which enabled the increasing automation of production processes. On the one hand, this led to further rationalization and, on the other, to mass production with many variants.

- The fourth industrial revolution

After mechanization, electrification and computerization, the focus is now on networking production processes as part of Industry 4.0. Intelligent networking will enable value creation processes to be planned and controlled in real time. This will enable more flexible and efficient production processes. This is realized by so-called cyber-physical systems (CPS). CPS refer to the integration of embedded information technologies in objects, materials, devices and logistics, coordination and management processes as well as their networking.

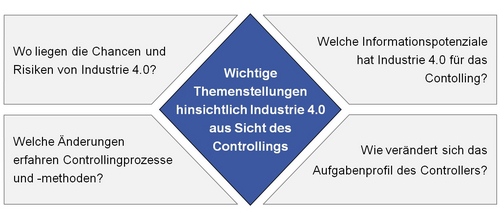

Topics relating to Industry 4.0 from a controlling perspective

Despite the integration of artificial intelligence principles, humans and their role as qualified decision-makers remain a central factor in the production environment. However, it is predicted that their role and the content of their work will change fundamentally within Industry 4.0 (cf. Spath et al. 2013). With our work in the Think Tank, we want to find out how this development will affect controlling and the controller. In order to develop this comprehensively, we will address the topics listed in Figure 2.

What is meant by “big data”?

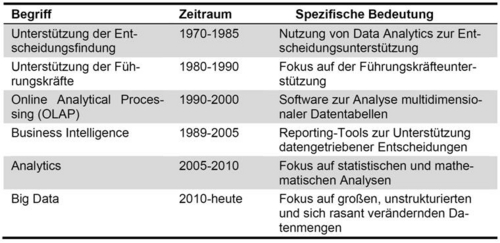

On the one hand, the term “big data” refers to the sheer unimaginable growth in the volume of data around us, the storage of which is neither a technical nor an economic problem today. On the other hand, it is repeatedly pointed out that only a small percentage of this data volume is actually analyzed and used. Basically, the term is part of the development of terminologies for the evaluation and analysis of data to support corporate management. The following table illustrates this development.

(based on Davenport 2014, p. 10)

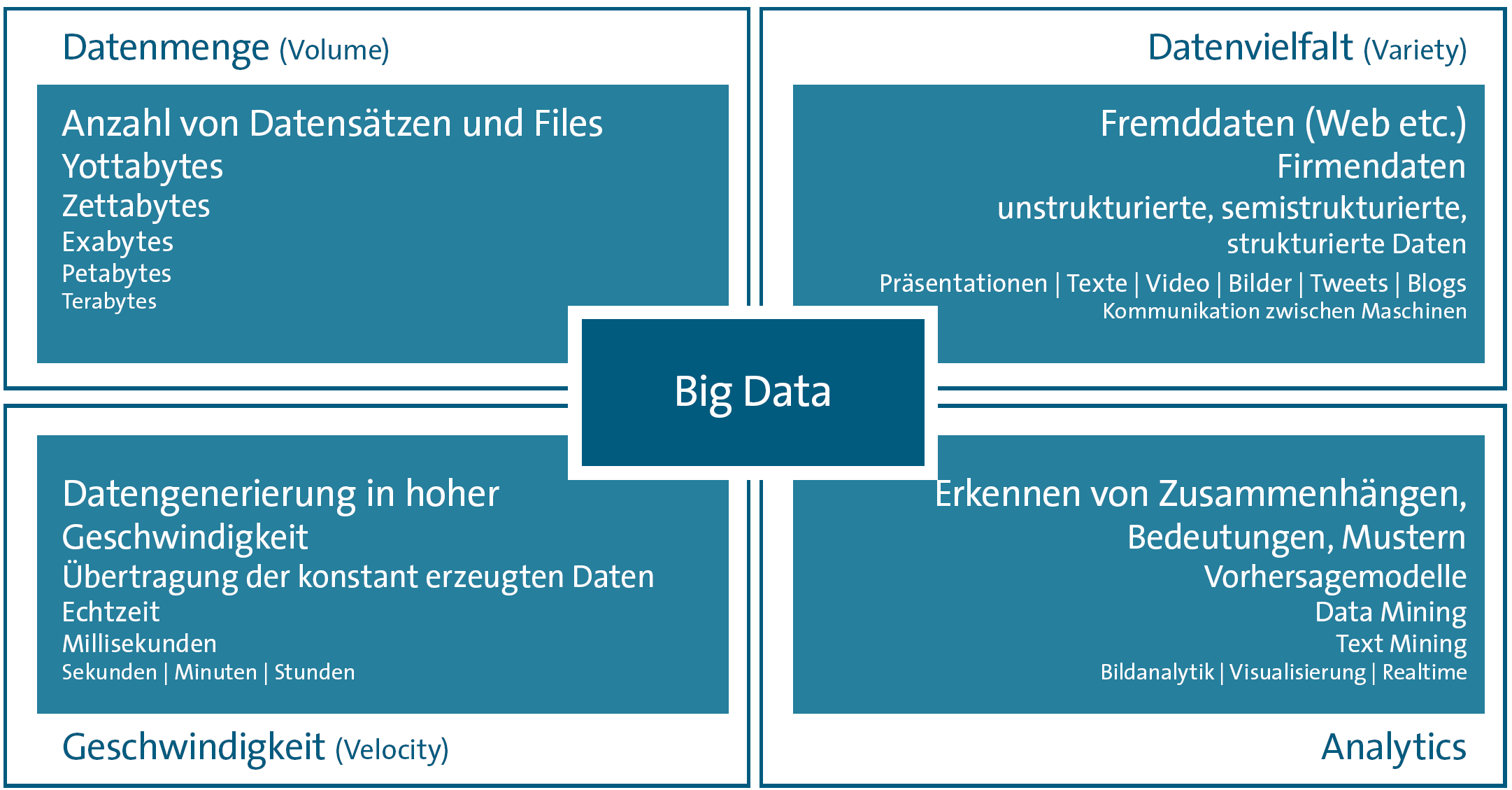

The German Association for Information Technology, Telecommunications and New Media(BITKOM) lists four key features that characterize big data to define the term:

- Volume (=amount of data)

As the term big data already implies, this includes both large amounts of data from terrabytes to petabytes, as well as many small amounts of data that need to be analyzed together. - Variety (=diversity of data)

It is not the large volumes of data per se, but the diversity of the data that presents both an opportunity and a challenge for big data. The data comes from internal and external sources and is available in structured (relational databases, etc.), semi-structured (log files) and unstructured (texts on the internet, but also video streams and audio files, etc.). - Velocity

The constantly changing and limited validity of data requires real-time or near real-time data generation and processing. - Analytics (=data analysis)

The management, analysis and interpretation of big data requires methods for the automated recognition and use of patterns, meanings and correlations such as statistical procedures, optimization models, data mining, text and image analysis, etc.

(according to BITKOM 2012, p. 19)

The intensive examination of the topic of big data shows that even this definition is not yet sufficient from a controlling perspective. Companies can only benefit from big data if they trust their data and can derive measurable added value from its analysis. This is because if the quality of the underlying information is poor, management will lose confidence in the data and rely on intuition rather than a solid data basis when making decisions. In addition, data specialists are needed who recognize the value of the data and generate a measurable, economic benefit for the company. For this reason, we would like to add two more Vs to the basic term in the Think Tank:.

- Veracity (=credibility)

It must be ensured that there is trust in the credibility of the data. - Value

The use of big data analytics can provide companies with economic benefits by giving them a deeper insight into their business, enabling them to develop new products and services, for example, and respond to changes relevant to the company as they occur.

Questions about big data from a controlling perspective

As part of the Think Tank, we look at the topic of “big data” from the controller’s perspective. In this context, we will address the following key questions in particular:

- What is big data? What is the potential of big data in companies and organizations? What are the risks? Is it all just a dream of the future?

- What significance does big data have for the controller?

- Where is big data changing the controller’s work? Where and how can they discover potential?

- Where does he have to critically scrutinize costs and risks as an “economic conscience”?

The phenomenon of “volatility”

Volatility and the uncertain and highly turbulent future associated with it is a regularly recorded phenomenon. Abraham Lincoln spoke of a “turbulent future” as early as 1862. Peter Drucker published his famous work “Managing in turbulent times” in 1980.

In recent months, the Think Tank has begun to focus on the phenomenon of increasing volatility, which has recently attracted a great deal of attention. Volatility is considered to be one of the ten topics of the future for controlling, both by academics and by specialists and managers in the field. The first aim of the effort is to examine the thesis of increased volatility and to develop a definition of volatility that is suitable for controlling practice.

Building on this, the aim is to examine which reaction options to high volatility are theoretically available to the management of companies and which are already being used in practice. Since controlling is always also a decision-making support for management, a change in corporate management always has an impact on controlling. The Think Tank will derive requirements for controlling in an increasingly volatile environment from this and use them to review existing controlling instruments and processes for their applicability in a volatile environment and adapt them if necessary.

What is volatility?

The term volatility is used in many specialist areas. In general terms, volatility is the short-term fluctuation of a time series around its mean value or trend. In economics in particular, volatility is a term that is often used but not clearly defined.

We have found an initial working definition for the upcoming work of the Think Tank at the ICV. We want to define volatility as the unpredictable fluctuation range and frequency of the external and internal economic parameters relevant to companies, the patterns of which are impossible or almost impossible to predict.

This very broad definition encompasses many events. It includes, for example, the volatility of commodity prices, shifts in demand and competitive positions, e.g. due to shorter product life cycles and technological change, or the strong economic fluctuations that have been observed since the 2009 financial crisis.

Volatility in the corporate context

At company level in particular, volatility is often described as a subjective, qualitatively perceived phenomenon of accelerated change, without operationalizing the concept of volatility. The broad definition of volatility favours a generalization of perceived effects. In order to be able to make a differentiated statement about the development of volatility and its influence on controlling, it is necessary to examine the fluctuations in the influencing factors of the companies and to identify volatility indicators. The decisive factor is the company-specific analysis of relevant indicators and not the development of a blanket measure.

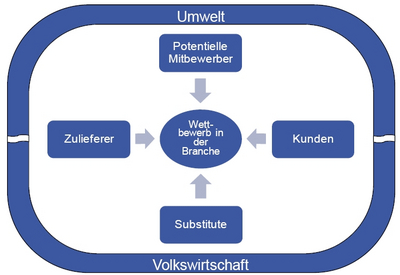

In our opinion, an extension of Porter’s “five forces model” to include influences from the environment and the economy to create a “seven forces model” of volatility analysis is suitable for this purpose (see figure). This should characterize the influence and impact of company-specific volatility in order to be able to consider the effects on companies in a differentiated manner. The aim of the Think Tank is to derive exemplary company-specific indicators for volatility and to use these to analyze the effects of changes in volatility on success.

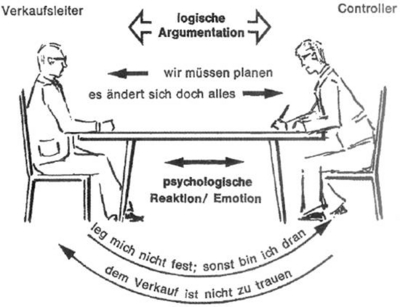

As early as 1974, Albrecht Deyhle illustrated the controller-manager dialog with a famous picture. Since controlling is first and foremost behavioral management, it is of course of crucial importance what goes on “under the table”. If you look around in practice, you will see that the cooperation between controller and manager focuses on the rational things that are “on the table”. They are “rational” and don’t even notice how what happens “under the table” shapes controlling.

Psycho-logic and logic under and on the table

(first Deyhle 1974, currently Deyhle & Radinger 2008, p. 701).

The ICV Executive Board and the Think Tank have recognized that there is a need to develop practical knowledge and make it available to practitioners. New findings from psychology have provided important impetus for the decision to investigate behavioral aspects of controlling. They show that our rationality is often influenced by distortions.

The result of these efforts is the Dream Car report from the Think Tank at the ICV “What makes controllers successful(-er)? | It’s the behavior that counts!”. This has three objectives:

- Compilation of the most important findings on the real decision-making behavior of managers as a starting point for the formulation of rules of conduct for the controller.

- Development of design recommendations for the recipient-oriented preparation and supply of information for the controller

- Suggestions for successful cooperation between manager and controller in the controlling process

In addition to the core team of the Think Tank, other experts were involved in the creation of the Dream Car Report. The Think Tank would like to thank the following for their kind support:

- Prof. Dr. Meike Tilebein, University of Stuttgart

- Dr. Hansjörg Neth, Max Planck Institute for Human Development Berlin

- Anja Kreidler, University of Stuttgart

As in the previous year, the theoretical findings were enriched by examples from corporate practice. We are particularly pleased that, in addition to German company representatives, we were able to attract companies from Austria for the first time this year. We would like to thank them for their support:

- German Lufthansa AG

- Hansgrohe AG

- MAN Truck & Bus Austria AG

- SKF Austria AG

- TRUMPF Machine Tools GmbH

- voestalpine Stahl GmbH

The green orientation of companies and its impact on controlling

The starting point of the discussion was the increasing strategic importance of environmental sustainability in companies and the resulting internal measurement and control requirements. This internal view is expanded by the numerous interests of external stakeholders, who increasingly demand information not only on financial, i.e. economic, performance, but also on the company’s ecological performance.

In practice, the strategic green orientation of the company, or “greening”, is closely linked to questions of measurability, economic efficiency and the selection of ecological measures. To this end, the core processes and instruments of controlling must be expanded or further developed to include ecological aspects. In this way, it is possible to sensitize stakeholders in the company to ecological goals, resolve conflicting objectives, evaluate opportunities and risks and ultimately implement sustainable strategies successfully.

The view of corporate environmental protection as a compulsory task and cost factor is considered outdated. Companies across almost all sectors have recognized the competitive relevance of a green company and are aligning their corporate activities, products and services accordingly in an environmentally friendly manner.

Environmental management is thus becoming a strategic task that is important for all functions in the company and must also be pursued across companies. The question of the significance of an increasing ecological orientation of companies, in the form of so-called “greening”, for controlling was the core of the work of the Think Tank at the ICV in 2010 and 2011.

On this page we present the results of the Think Tank from 2010. The results were compiled by the core team of the Think Tank together with the companies Duetsche Lufthansa AG, Hansgrohe AG and Trumpf GmbH + Co KG.

ICV Green Controlling Study

The aim of the study was to assess the relevance of greening from the perspective of controllers, to analyze the status of green controlling in practice and to identify the resulting future challenges. A total of 295 ICV members took part in the study.

The study has shown that ICV members see the current discussion about “greening” as an ongoing development that also brings new challenges for controlling. Controllers see their own active role in supporting greening, which is similar to the role of a green business partner.

Controllers should support the ecological orientation of companies methodically and instrumentally, if this has already been initiated, or actively promote the topic within the company if opportunities and risks for achieving corporate goals are seen. Ecological and economic correlations must be constantly scrutinized and transparently presented by the controlling department against the backdrop of changing external conditions.

Depending on four green strategy types, the status and requirements of green controlling were examined. It was found that controllers see an increasing need to integrate ecological aspects into controlling processes, especially where the strategic importance is high. To this end, suitable instruments need to be developed, unresolved issues in the cooperation between controllers and environmental managers need to be clarified and possible conflicts of objectives need to be resolved, and a major challenge lies in solving the problem of measuring and evaluating ecological aspects and integrating them into existing IT systems and instruments.

You can find the full study report here.

ICV White Paper Green Controlling

Based on the results of the study and the need for action identified there, the white paper describes conceptual options for “greening” controlling. This is done for a selection of controlling processes in accordance with the IGC controlling process model. For example, approaches for green strategic planning, green cost and performance accounting and green management reporting are presented. Examples from the companies Lufthansa, Hansgrohe and TRUMPF supplement the explanations with experiences on the approach, the experiences, the current status and the planned steps of green controlling in the three companies.

You can find the white paper on Green Controlling here.

Publications of the Think Tank

The results of the Think Tank were also published and presented in various media. Further information can be found in these publications.

- Horváth, P./Isensee, J./Michel, U., “Green Controlling” – Bedarf einer Integration von ökologischen Aspekten in das Controlling, in: Tschandl, M./Posch, A. (eds.), Integriertes Umweltcontrolling, 2nd edition, Wiesbaden 2011, pp. 39-58.

- Isensee, J./Michel, U., Green Controlling als (neue) Aufgabe für den Controller?, in: Controller Magazin, 36. Jg. (2011) H. 4, S. 18-20.

- Isensee, J./Michel, U., Green Controlling – Die Rolle des Controllers und aktuelle Entwicklungen in der Praxis, in: CONTROLLING, 23. Jg. (2011) H. 8/9, S. 438-444.

- Isensee, J./Henkel, A.,Die Herausforderung des Green Controllings – Ergebnisse einer empirischen Studie und das Beispiel STABILO International GmbH, in: Controlling-Challenge 2015, Der Controlling-Berater, Band 17, Freiburg 2011 (in print).

Dr. Uwe Michel and Johannes Isensee presented the results of the Think Tank as well as experiences with green controlling from the companies Alfred Kärcher GmbH & Co. KG and STABILO International GmbH at the 36th Congress of Controllers in Munich on 16.05.2011.

Think Tank

Dr. Kim Louisa Dillenberger

Think Tank, Coordinator & Editor

Vice Academic Director, Centre for Performance Management & Controlling, Frankfurt School of Finance & Management, Frankfurt/Main

Prof. Dr. Ronald Gleich

ICV Think Tank, Management

Academic Director, Centre for Performance Management & Controlling, Frankfurt School of Finance & Management, Frankfurt/Main

Prof. Dr. Heimo Losbichler

Board of Trustees (ICV)

IGC Chairman, International Group of Controlling , Steyr

Dean of Controlling, Accounting and Financial Management, FH Upper Austria, Faculty of Business and Management, Steyr

e-mail: heimo.Losbichler@fh-steyr.at

On LinkedIn

Stefan Patzke

ICV Think Tank

CFO & Member of the Board of Directors, Alfred Kärcher SE & Co. KG, Winnenden