Call for Participation: New Work and its Impact on Employees and Organizations

As part of a research project in cooperation with the Centre for Performance Management & Controlling at the Frankfurt School of Finance & Management, the ICV Think Tank cordially invites you to participate in its current study on the topic of “New Work and its effects on employees and organizations”.

The study examines how modern work concepts influence controlling and other areas and what effects this has on employees and organizations. The aim is to better understand how flexible and employee-oriented approaches change traditional hierarchies and processes and what new dynamics arise in the team.

Your benefits as a participant:

- All participants will receive the results of the study upon request and thus valuable insights into the current developments and challenges in the field of controlling. In addition, books on current topics in controlling will be raffled off among the participants.

- The survey takes approximately 15 minutes and all data will be treated anonymously and confidentially.

- The results are published exclusively in aggregated form, so that no conclusions can be drawn about individual companies or persons.

Participation is possible until January 31, 2025.

You can participate here – in English or German

We would like to thank you in advance for your participation!

Talent retention in accounting and finance in Europe

This study analyses the factors contributing to turnover in the financial services industry in Europe and offers actionable solutions for effectively retaining talent. Retaining top talent is essential for companies to secure sustainable growth and competitive advantage, as well as ensuring long-term success in a dynamic business world.

However, a shrinking pool of workers, coupled with declining interest in accounting and finance careers among graduates, is leading to a talent crisis in Europe. The research shows that many professionals in these fields change employers frequently, with a quarter of respondents saying they plan to leave their current employer within the next 12 months.

Although there are country-specific differences across Europe, the study shows that job satisfaction, career advancement opportunities, work flexibility, employee engagement and a sense of belonging are key factors in determining whether employees consider changing jobs or careers. As CFOs and other accounting and finance leaders consider talent retention a priority, a continuous review of talent retention strategies is necessary. These must respond to new challenges posed by technological advances, changes in workforce demographics and evolving employee expectations to ensure long-term organizational growth.

IMA® (Institute of Management Accountants) with support from EMEA Recruitment, among others, conducted this study as an online survey among more than 200 current and former accounting and finance professionals in Europe.

We would like to thank the IMA for allowing us to make this study (in English) available to our readers!

WHU CONTROLLER PANEL in cooperation with the ICV

The WHU Controller Panel was founded in cooperation with the ICV in 2007 and since then has offered scientifically sound analyzes and practice-relevant benchmarks on all important facets of controlling. It is led under the joint directorship by Prof. Dr. Marko Reimer, Prof. Dr. Utz Schäffer und Prof. Dr. Dr. h. c. Jürgen Weber. Over 1,000 members regularly take part in the studies.

The regular survey on relevant longitudinal topics enables statements about development of controlling in the German-speaking area (Germany, Austria, Switzerland). Studies highlight both current trends and core controlling issues.

Are you interested in the results and analyzes of the WHU Controller Panel? Then register at whu-controller-panel.de.

Membership is free and can be canceled at any time. You are invited to participate in a study three times a year; answering the online questionnaire usually takes about 10 minutes. The surveys are anonymous and all information is kept strictly confidential.

Contact:

- Prof. Dr. Marco Reimer

- Prof. Dr. Utz Schäffer

E-mail: whu-controllerpanel@whu.edu

WHU - Otto Beisheim School of Management

Institute of Management Accounting and Control (IMC)

Study results of the WHU Controller Panel (PDF download, free of charge, in German)

- Salary and performance appraisal of controllers (2024)

- ESG-mnagement - claim and reality (2024)

- The future topics of controlling (2023)

- Budgeting - status quo and new developments (2023)

- Salary and working environment of controllers (2023)

- Fit for the future? Competence profile of controllers (2022)

- Management Reporting in turbulent times (2022)

- What do adaptive companies do differently? (2022)

- How do controllers and IT shape the controlling (2021)

ICV Green Controlling Study 2022

The aim of the ICV Green Controlling Study 2022 was to determine the status quo of green controlling in companies in the DACH region and to compare it with the results of the two previous ICV green controlling studies from 2011 and 2016. In addition, the relevance of individual trends and upcoming challenges were worked out.

The ICV Expert Work Group Green Controlling for Responsible Business organizes the study together with the ICV Think Tank.

Authors: Andrea Kämmler-Burrak, Horváth & Partner GmbH, Stuttgart; Dr. Marco Möhrer, Robert Bosch GmbH, Stuttgart; Prof. Dr. Peter Rötzel, Technische Hochschule Aschaffenburg, Aschaffenburg; Prof. Dr. Mike Schulze, CBS International Business School, Mainz; Nils Gimpl, Frankfurt School of Finance & Management, Frankfurt/Main.

The study is available in German and English here in the ICV OnlineShop as a PDF download.

ENGLISH OR GERMAN:

- Free of charge for the ICV members: ICV Online-Shop

- For non-members for 29,00 euros: ICV Online-Shop

IGC Study Report: Digitization in Planning, Budgeting and Forecasting

Management Summary: The study of IGC International Group of Controlling sets out to explore the application of digital instruments and digitalized processes in corporate planning, budgeting and forecasting. Digital instruments encompass statistical methods, business analytics and the like while digitalized processes are either fully automated and done by

a software or bots perform previous manual tasks with robotic process automation. Planning, budgeting and forecasting are especially suitable for this discussion because they involve many sets of information and consume many resources in firms.

In the area of operational planning and budgeting, the following technologies for digitization are primarily mentioned in the literature: Big Data, Predictive Analytics, Business Analytics. In addition, the possibility of using artificial intelligence (AI for short) is discussed, especially in forecasting.

Use cases in practice range from the introduction of specific tools for digitization to the implementation of a company-wide integrated planning, budgeting and forecasting solution with AI and analytics components, which can be used for simulation purposes, for example.

Companies pursue a variety of goals with the introduction of technologies in planning, budgeting and forecasting. Besides reducing variances and improving the quality of planning and forecasting, there is also a push to increase automation and the associated reduction in costs.

It is apparent that the current state of digitization in planning, budgeting and forecasting is low and the adoption of technologies is still limited. Only a small proportion of the companies surveyed reported that they already had experience with the technologies mentioned above. This holds except for the use of driver models and scenario planning which are more widespread.

Proven methods are primarily used for planning and budgeting (traditional planning, classic budgeting). However, rolling planning and, in some cases, better budgeting are gaining in relevance.

The study hints to several roadblocks for digitization. The main obstacles are the lack of knowledge and insufficient capacities. Problems of acceptance and an insufficient information base are also

a challenge. The case for introducing digital technologies is also hard to make, especially in regard to financial outcomes.

We thank IGC - International Group of Controlling - for providing this study.

Hackett Study: Finance in 2024 with an unchanged focus on Intelligent Automation

Finance executives rely on digital automation to sustainably increase performance and productivity.

In the 2023 financial year, the agenda of most companies was determined by securing supply chains, combating inflationary price developments and the shortage of skilled workers. The ongoing war between Russia and Ukraine, as well as the Israel-Hamas conflict, create geopolitical uncertainties and risks. There were legitimate fears of a recession circulating among company management levels.

At the beginning of 2024, these risk factors have further intensified. This is clearly reflected in the Hackett Group's current Finance Study: 62 percent of the approximately 375 internationally surveyed managers in medium to large companies fear that rising loan interest rates will endanger their necessary investments. 57 percent, or more than half, expect a recession in the current financial year. In addition, the study continues, 46 percent of executives consider a lack of qualified employees as an additional reason for massive disruption to their business.

Increasing profitability through productivity improvements will continue to be at the top of the corporate agenda in 2024 in order to successfully overcome challenges such as higher interest rates on capital, an impending recession or the ongoing shortage of skilled workers. It can be assumed, according to The Hackett Group in the study “The CFO Agenda”, that investments in advanced technologies such as (generative) AI (artificial intelligence) will not be affected by the need for austerity: instead, they will increase significantly in 2024. In general, finance executives focus on digital transformation to reduce costs and generate new business: This includes areas such as business customer experience (18% of managers), virtualized data platforms (15%), digital workflows (13%) and robotic processes automation (RPA) (13%) can be optimized.

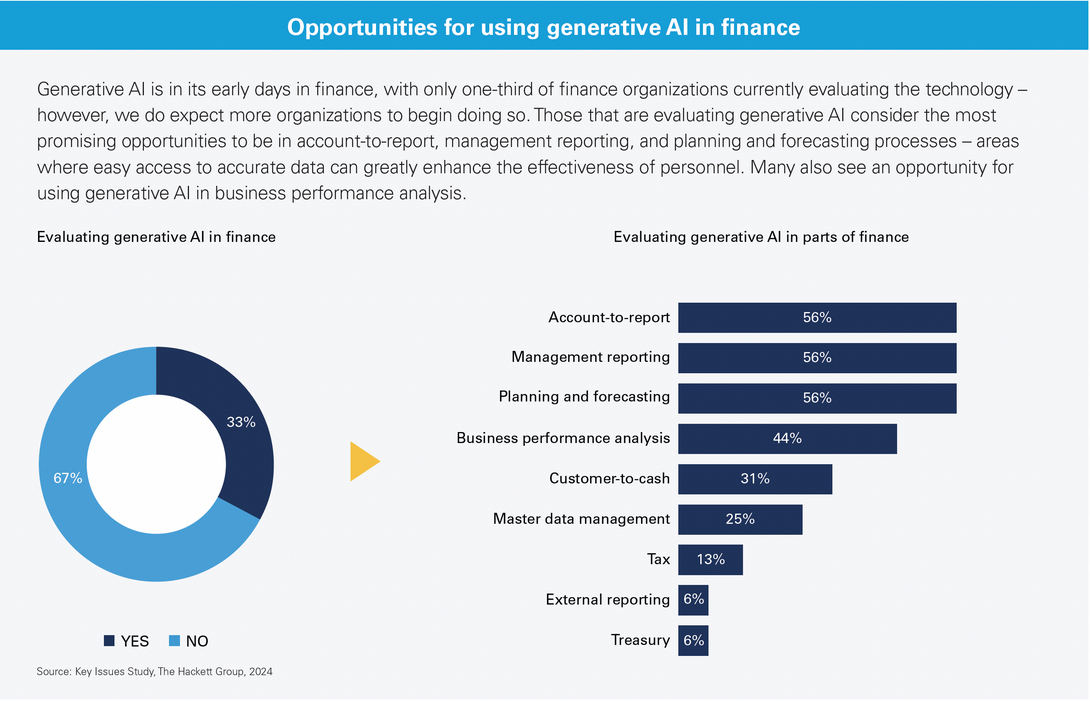

Executives are forecasting 9% growth for Generative AI (Gen AI) in the current financial year and 41% of executives and companies surveyed see the greatest benefit of Gen AI in the areas of reporting, management planning and forecasting. “In the 2024 financial year, profitability and optimized cash flow are at the top of the finance agenda,” says Georg Bach, MD DACH of the Hackett Group.

You can download the study directly here:

-

Finance_Key_Issues_2024.pdf [954 KB

Hackett Study: Digital transformation has the highest priority for finance in 2023 - for more output, effectiveness and speed

Finance executives continue to attach the highest priority to digital transformation in the 2023 financial year in order to effectively counteract the economic downturn, inflation, geopolitical upheavals, but also the shortage of skilled workers. This is shown by the Hackett Group's current CFO Study, for which around 350 managers from international medium-sized and large companies were surveyed - around a third of them European and DAX companies.

The finance executives list the following main agenda items for the current financial year:

- Effective support of growth strategies

- Provisions against unforeseeable events

- Optimized business partnerships and

- Increase in finance agility.

According to the Study, these objectives must be achieved above all with more investments in technologies: Because in 2023 the workload in finance will grow by around 8 percent, while at the same time the staffing level and budgets will shrink by one to two percent. In order to avoid slumps in productivity of up to 9 percent, the finance departments will invest around 5 percent more in technology in 2023 in order to be able to increase their productivity and performance ̶̶ despite the existing difficult general conditions.

But: The study also proves a serious mismatch between the necessary to-dos in the financial area and the self-assessment of managers to be able to implement their agenda effectively: Although almost 75 percent of those surveyed emphasize the importance of digital transformation, less than a third pursue initiatives, with which important tasks could be carried out. Managers have little confidence, for example, in their ability to

- provide the necessary employee talent

- develop business insights and strategies using sophisticated data analytics

- increase agility and

- reduce costs.

"The break between what is recognized as necessary and the negative expectation of being able to realize it is very unsettling," says Georg Bach, MD Central Europe at the Hackett Group, assessing this study result. “This is particularly alarming when it comes to talent management: Only 8 percent of the companies surveyed and examined consistently pursue initiatives to train the skills of their employees: For analytics, new technologies, process design and other important areas. Such omissions will have a negative impact in the medium and long term.”

Georg Bach continues: “It is just as worrying that many companies are still not sufficiently prepared for unforeseeable, disruptive events. Companies must recognize recessions and economic risks in good time and be prepared in every direction with a variety of scenarios and planning. Companies need to work harder on that."

Hackett study: European Companies Significantly Reduced SG&A Expenses in 2021

Hackett study: European Companies Significantly Reduced SG&A Expenses in 2021

After many years of stability in selling, general and administrative (SG&A) costs, European companies dramatically improved their efficiency in 2021, cutting SG&A expenses by nearly 7% in response to an increasingly challenging business environment, according to new research from The Hackett Group.

The Hackett Group’s first-ever “2022 European SG&A Study and Scorecard” examines the SG&A expenses of the 1,000 largest listed companies in Europe. The study results break down operational cost performance in 11 GICS (Global Industry Classification Standard) industry sectors, and lists top performers and laggards for each industry.

The study found that European companies reduced SG&A costs to 13.7% of revenue, down from 14.7% in 2020. This drop of 6.8% is unprecedented in recent history. But

the decline was also largely restricted to just a few of the 11 sectors in Europe. Improvements were only seen in four sectors – consumer staples, health care, materials and utilities. Six other sectors remained stable, while one – real estate, actually saw SG&A expenses increase.

Download the study here

-

SG_A_EUR_2022_FINAL.pdf [5 MB

Hackett: Inflation in the focus of two studies 2022

In the current studies "Understanding and Managing the Impacts of Inflation" and "The Hackett Group's Finance Guide to Effectively Manage and Mitigate Inflation", The Hackett Group publishes recommendations for action on how to successfully counteract the effects of inflation. Summarizing the results of both studies, here are the six areas and focal points that are important:

- Product and service mix, pricing strategies, customer segments and sales channels

- Intelligent cost management

- Smart Sourcing

- Wages and compensation structures

- Hedging strategies – forex, commodities and interest rates

- Provision of relevant skills

- Retention management

Important approaches and focal points are:

- Employees with inflation experience are valuable. Economic forecasts assume that inflation will persist over the long term. Forward-looking planning and valid forecasts are therefore important. A lack of experience of finance employees with inflation in Germany can be compensated for by the targeted deployment of employees who are already experienced in dealing with inflation. Greater use should be made of the skills of employees who have already worked in highly inflationary countries such as Argentina or Brazil, or new staff with this prerequisite should be recruited.

- Sales planning and management. Increasing procurement and production costs have an impact on sales and margins, which should be countered by effective customer and profitability planning. Optimized customer prices and rationalization of the product and service mix, as well as effective cooperation with sales and marketing are decisive for optimizing sales and earnings.

- Intelligent cost management. Finance must work closely with senior management to analyze short and long-term risks and benefits. This ranges from optimizing the supplier portfolio to ensuring the ability to deliver in the long term, also through vertical integration. In this context, The Hackett Group repeatedly points out the need to use digital "best of breed tools" in enterprise performance management or to generally increase the efficiency of processes. In this way, the performance of Finance can be significantly increased and costs can be sustainably reduced.

- Reserve and secure finance talents. Increasing employee turnover is expensive, leads to losses in knowledge and productivity and causes falling motivation and loss of reputation - not only in times of crisis. To counteract this, the finance management level must improve communication between management and staff, offer development opportunities, adjust wages and remuneration in line with the market and offer hybrid workplace models. Finance should make the workplace culture as attractive as possible through incentive systems in order to be able to benefit from qualified workers even in crisis mode.

Minimum requirements to get the inflation risks under control: In addition to absolute baseline transparency on the cost side, the orientation of the price strategy, including the skimming off of possible price increase potentials, is becoming increasingly important. And: We do not recommend reprioritizing planned investments in digital transformation so as not to jeopardize or delay future contributions to value creation.

The ICV corporate member The Hackett Group has made the detailed result of one of the two studies available to our readers for direct download here:

Study: Understanding and Managing the Impact of Inflation

To the podcast "How to manage and mitigate inflation"

Hackett Study 2022 Key Issues: The Finance Agenda

The crisis year 2022 once again poses major challenges for the finance sector

The expectations of finance executives for the 2022 financial year are and remain ambivalent. They rely on growth and expansion in the area of digitization and business areas, but they also know about the enormous effort involved in risk management with a view to supply chains, for example. Risks that are already foreseeable include the "war of talent", cyber risks and increases in inflation. There are also external factors such as the course of the pandemic and war events such as those currently taking place in Ukraine. All of this further exacerbates the uncertainty in the markets.

The ambivalences are shown in detail in the study "2022 Key Issues: The Finance Agenda". It highlights four tasks that finance executives see as priorities for 2022. The study is based on the statements of 250 international top-level executives. You can download it for free here on The Hackett Group's external site http://go.poweredbyhackett.com/22finkey2201sm or directly below.

You can download the Study here

Hackett Study 2021: The new digital world-class finance standard

Added value for financial organizations through cloud, RPA and smart analytics

The Hackett Group benchmarks have been the reference parameters for globally active companies in the area of business unit performance for decades. "World Class Performance" has been the standard so far. In order to take into account the current developments and effects of the digital transformation, the ICV corporate member Hackett Group has raised the bar to a new level: The Digital World-Class Finance Standard. A current Hackett Study provides information on how the new standard can be achieved and what advantages can be achieved. To this end, around 200 large international companies with sales of over one billion US dollars were examined, mostly via benchmarking, but also in projects ̶ the proportion of European companies is around 40 percent, including leading DAX and MDAX companies.

The central finding: digitization measures significantly increase the efficiency and effectiveness of financial organizations, added value is achieved through the cloud, RPA and smart analytics.

You can download the study here

Contect of this page

Current info

- New Work and its effects on employees and organizations

- Talentbindung in Accounting und Finance in Europa

Cooperation partnerships

Frankfurt School Data Analytics Study

WHU Controller Panel

ICV own studies

ICV Green Controlling Study (2022)

IGC International Group of Controlling

Study Report: Digitization in Planning, Budgeting and Forecasting

The Hackett Group Studies

Hackett:Digital transformation has the highest priority for finance in 2023

Hackett: European Companies Significantly Reduced SG&A Expenses in 2021

Hackett: Inflation iin the focus of two studies 2022

Hackett Study: 2022 Finance Key Issues

Hackett Study 2021: The New Digital World-Class Finance Standard

YOU CAN ALSO FIND FURTHER INTERESTING INFORMATION HERE:

ICV Literature

ICV publication series and ICV White Papers

ICV PODCASTS

Podcasts from the ICV events, ICV awards, from ICV members, ICV partners and more.

Benchmarking by the ICV and SAP

In cooperation with SAP, the ICV offers you a survey with subsequent individual evaluation and optimization suggestions for your financial and controlling processes. The first survey is over. We will inform you as soon as the next opportunity to participate is available.